Finding my Weekly Rhythm

One of the habits I’ve been trying to build into my startup journey is a weekly rhythm:

By Friday, have ~10 sales calls completed and logged in the sprint tracker (this week I had 12!)

Use what we learn to draft a new case study hypothesis for the following week

Each week, run the same loop: test the hypothesis, try to sell, analyize what happened, adjust, repeat

Over time, find pull and invest in building there

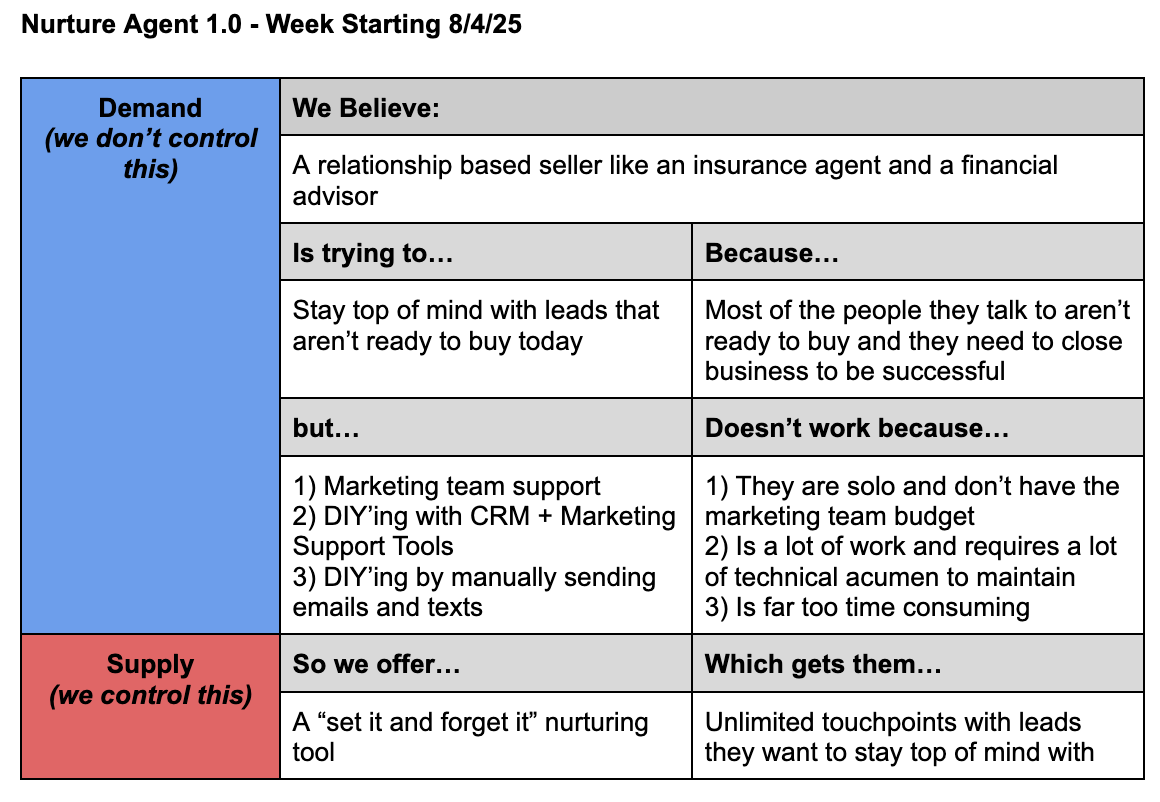

This week’s 12 calls were with a mix of solo agents, small teams, and brokers across insurance and financial services. I went in with the “relationship-based seller” case study hypothesis as outlined below:

The core idea for this hypothesis is if you work in a trust-driven business, you need to stay top of mind with leads who aren’t ready to buy today. “Hang around the hoop” as one person I talked to put it.

What I was looking for was PULL: not just “that’s a nice idea,” but “this is a project I need to solve right now and there are no other good options.”

Three of the twelve gave me a signal of PULL.

“I’ve got 40–50 thousand names sitting in a spreadsheet and no system to work them.”

“We’re sending 20k emails a week already. If your tool can personalize each lead without more work, we’d 100% use it.”

The other nine? It wasn’t that they disliked the idea. It’s that they didn’t feel the pain right now. Some were just getting started and didn’t have a book to nurture yet. Others were content with their current process. A few flat-out said they wouldn’t trust AI with something so personal, which I flagged as common for higher end commercial insurance agents.

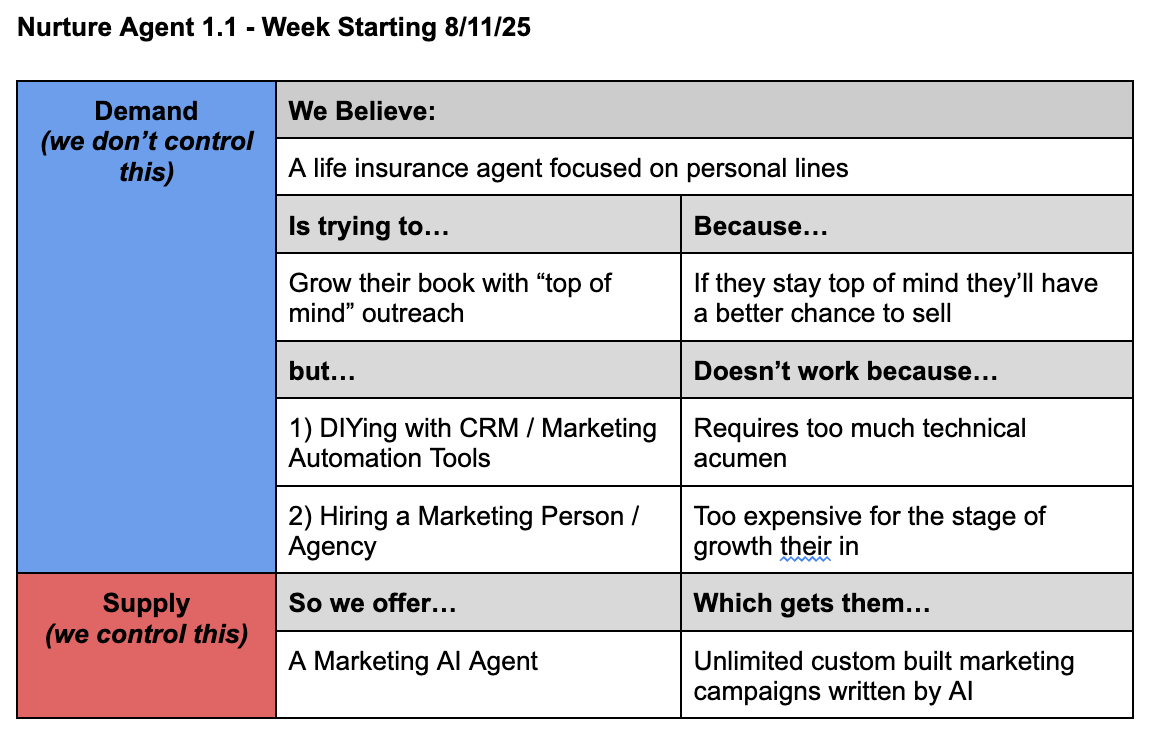

The pattern that emerged was clear: the strongest pull is with life insurance agents selling personal lines who rely on heavy volume outreach.

So that’s where I’m pointing next week’s sprint. The new case study reflects the shift: narrower segment focused on life insurance agents.

It’s not the broad, relationship-seller story I started with, but if the goal is to find the “must cross the river” problem, this is closer.

Next week, I’ll run another 10 calls, this time aimed squarely at that life insurance wedge. We’ll see if the pull gets stronger and I’ll report back next week.

#HappyLearning